- 1 Minute to read

- DarkLight

- PDF

How to Add a Tax Type

- 1 Minute to read

- DarkLight

- PDF

Step-by-step guide

- Go to Setup > Tax & Currency > Tax.

- Click on the Tax Type button to add a new tax type.

- Click on the Add button at the Tax Type screen.

- Enter the new Tax Type details, then click on Add.

- When finished, the New Tax Type screen will show the tax you just added.

Click on Save and then Quit.

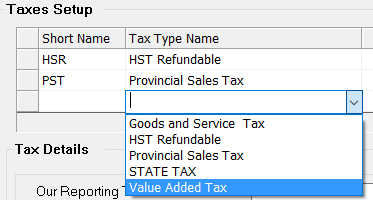

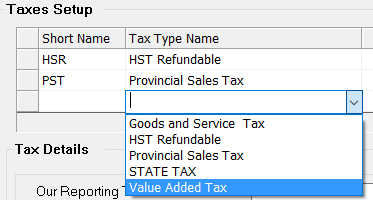

The last step is to add and edit the new tax type in the Tax Default Settings screen. UnderTaxes Setup, click on the empty field and then click on the new tax type to add it to the list. From the drop-down arrow bar, choose the tax you just added to the list (e.g. Value Added Tax).

To show the Tax number on the Sales Receipt, type in the number provided by the government in the Our Reporting Tax Number field. Check off the Show Tax-in-Price onReports box and keep the Effective Date / Cancel Date fields blank.

- Under the Sales Tax section of the screen, Charge/Show on Sales should be checked off if the tax will be applicable for all sales. Checking off the Charge on Freight Out box is optional (if you charge this tax on shipping out products). Set up the Rates that are appropriate to your region, and make sure that Regular and Show Tax Number are checked off.

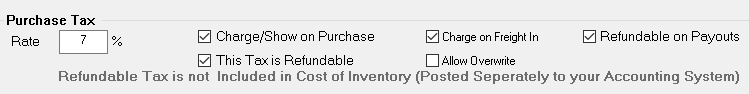

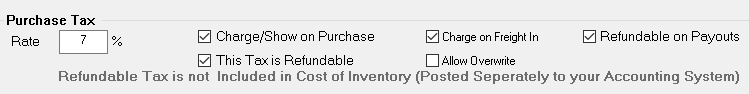

Under the Purchase Tax section of the screen, check off the Charge/Show on Purchase box (make sure it is the applicable to your region). Charge on Freight In should be checked on as well (based on the tax settings in your region) - e.g. it is applicable in Ontario for GST but not for PST.

Check off Allow Overwrite so that you can overwrite it on the Purchasing Document / Receiving Invoice. Check off Refundable on Payouts, which is based on the regional settings. For example, if you make a purchase for your business out of your cash drawer, you should record it as a Payout to track money float. When any expense like this happens, you are paying taxes on the goods bought. You might be entitled to a tax refund (depending on the tax law in your area) that will be based on the tax rate set right here.

- Make sure you set all the applicable taxes, then click Save. Then click Quit to exit that Tax Default Setting screen. You’ve finished setting up your taxes.